When wages exceed RM70 but not RM100. As mentioned earlier interest on EPF is calculated monthly.

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Employees Deposit linked insurance AC 21 0.

. 367 Employees Pension scheme AC 10 0. The FY 2021-22 EPF interest rates are as per the date March 12 2022 EPF Contribution Rate FY 2021-22. 065 From 01042017 Previous-085 from Jan 2015 or min Rs.

Yes the member can contribute beyond the wage ceiling limit of Rs. The member can also contribute on higher wages ie greater than Rs. Employees contribution towards EPF 12 of 30000 3600.

Revised rate of interest - with regard to Staff Provident Fund in EPFO HO No. Earlier in the year 2016-17 and 2018-19 the EPFO had given an 865 rate of interest to the subscribers. From 1990001 to 2000000 240000 220000 460000.

Assume that you the employee in this case joined the job exactly on 1 st April 2018. Lets use this latest EPF rate for our example. 050 EPF Administrative charges AC 2 0.

Contribution Table Rates Jadual Caruman SOCSO A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. The EPF contribution rate for the financial year 2021 is 85. 001 or min Rs.

This will enable you to ensure your salary has been correctly deducted and also serve as proof of your EPF contributions. When wages exceed RM50 but not RM70. Given below is a list of interest rates of some of the previous years-.

Total EPF contribution every month 3600 2350 5950. Currently the mandatory monthly contribution by the employee stands at 12 per cent of the monthly pay which includes monthly basic pay dearness allowance and retaining. Wages up to RM30.

Corrigendum to circular dated 06042022 on Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit HONoWSU612019Income TaxPart-IE-33306 dated 15072022 24MB 115. 500- EDLIS Administrative charges AC-22 0. And for the months where the wages exceed RM2000000 the contribution by the.

The minimum statutory contribution by employers to Malaysias Employees Provident Fund EPF for employees aged above 60 will be reduced to 4 per month down from the previous 6. This privilege is only for the first three years of employment. Employers contribution towards EPS subject to limit of 1250 1250.

Given below is a list of interest rates of some of the previous years-. The EPF interest rate for FY 2018-2019 is 865. 12 Ref Contribution Rate Section A.

For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. 00 Da ri Jan 20 2022 Jadual Potongan Kwsp 2019 Caruman Bulanan Jadual Caruman Kwsp 2019 Caruman Bulanan Jadual Caruman Kwsp Pekerja Dan. Employee shall be calculated at the rate of 11 of the amount of wages for the month.

The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. Which is distributed as 833 towards the Employees. Employers contribution towards EPF 3600 1250 2350.

The EPF contribution rate for the financial year 2021 is 85. When wages exceed RM30 but not RM50. 65 Ref Contribution Rate Section C More than RM5000.

The EPFO has decided to provide 850 percent interest rate on EPF deposits for 2019-20 in the Central Board of Trustees CBT meeting held today states Gangwar. Employer contribution Employee provident fund AC 1 12. You are advised to keep and check your salary slips throughout your employment.

By noticing this trend you have to still have a big relief that you are under the second-highest interest rate group currently as the EPF Interest Rate 2019 2020 is 85. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. The contributions made by employer and employee towards the EPF account is the same.

So the EPF interest rate applicable per month is 86512 07083. Ref Contribution Rate Section E RM5000 and below. The minimum Employers share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the Employees share of contribution rate will be.

RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 8001 to 10000 1300 700 2000 From 10001 to 12000 1600 900 2500 From 12001 to 14000 1900 1000 2900 From 14001 to 16000 2100 1200 3300 From 16001 to 18000 2400 1300 3700. Contribution By Employer Only. 15000 but only up to a maximum limit of 100 of the PF wages provided they get permission from the APFCRPFC as per the provisions of para-26 6.

This privilege is only for the first three years of employment. For those who would like to know more about their contribution rate you can view the rates below up to the age of 60. 13 Ref Contribution Rate Section A Applicable for ii and iii only Employees share.

If you check out the historical EPF contribution rate it increased a lot from around 625 in 1956 to currently at 12 of BasicDA. EPF contribution of both employer and employee 12 percent each for the next three months so that nobody suffers due to loss of continuity in the EPFO contribution This is for those establishments that have up to 100 employees and 90 percent of whom earn under Rs 15000 monthly wage This will benefit about 80 Lakh employees. The total contribution ie voluntary mandatory can be up to Rs.

How To Calculate Interest On Your Epf Balance Mint

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Interest Rate From 1952 And Epfo

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

What Is The Epf Contribution Rate Table Wisdom Jobs India

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Epf New Basic Savings Changes 2019 Mypf My

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Epf Interest Rate 2019 2020 Historical Interest Rates From 1952 To 2019

Epf Interest Rate From 1952 And Epfo

Epf Change Of Contribution Table Ideal Count Solution Facebook

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

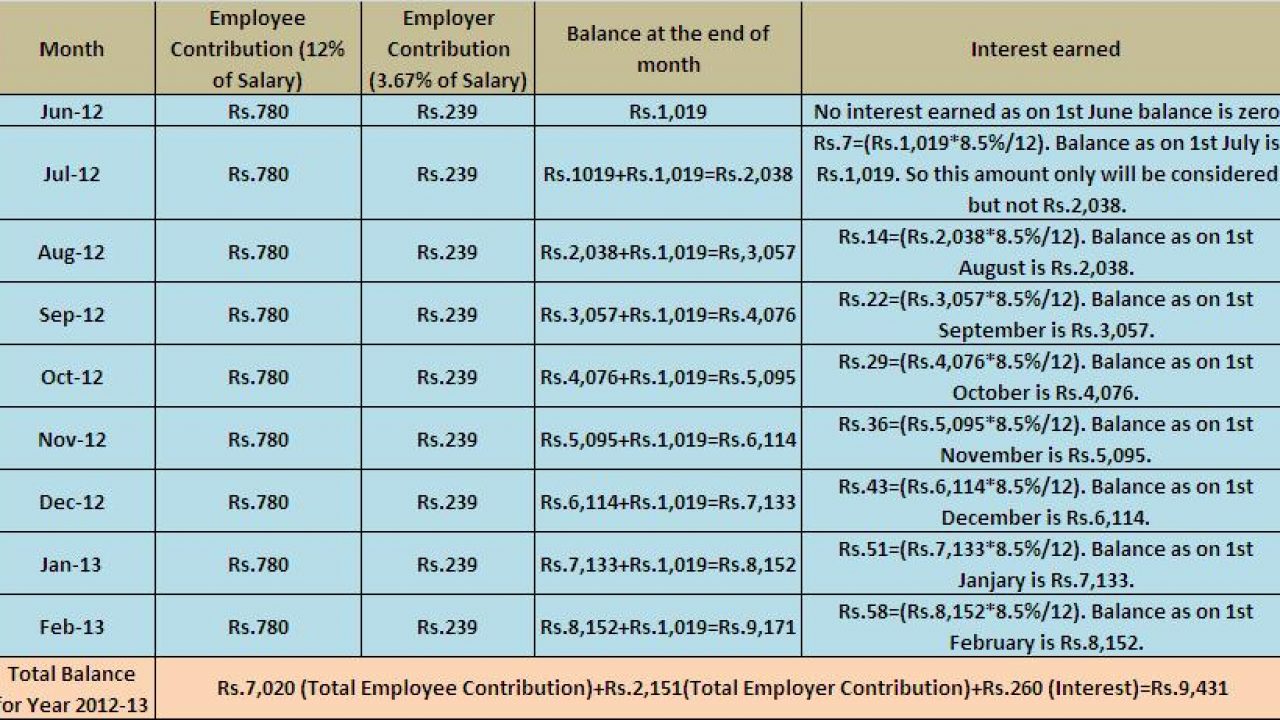

How Epf Employees Provident Fund Interest Is Calculated

- holde hvide sko rene

- cahaya putih prisma kaca

- air asia kl sentral

- bank exchange rate malaysia

- cek nama pos laju

- lantai kamar mandi warna putih

- resepi nasi daun teratai

- jawatan kosong johor bahru terkini

- teks ucapan pengetua hari anugerah cemerlang

- sinopsis buku pendidikan psikologi

- hvide bukser pletter

- setelah terlafaznya akad episod 15

- utropolis glenmarie for rent

- ebook sejarah hitam yahudi

- produk hilangkan jeragat

- kad pengenalan perkahwinan

- contoh surat jemputan formal

- utc keramat mall

- building plan submission malaysia

- paku untuk rambut palsu